The Effect of Rising Interest Rates on Option Strategies

In 1973, economists Fischer Black and Myron Scholes published “The Pricing of Options and Corporate Liabilities,” which was the birth of the modern option pricing model that is still today’s gold standard for valuation. The formula isn’t perfect and has some limitations, but for the most part it’s withstood the test of time. We’re not going to get too into the weeds with the complex mathematical formula that they created, but if you want to learn more about it you can here.

What’s important to glean from the Black-Scholes Model are the factors that have a first-order effect on option prices and the extent of how changes in those inputs alter the underlying option price. There are 5 basic inputs that determine the price of an option:

- Underlying Asset Price – The price of the stock, index, or ETF. Higher-priced assets generally have higher option prices on a dollar basis (but not a percentage basis).

- Implied volatility – The market’s expectation of the future volatility of this asset1Not to be confused with historical volatility, which measures how volatile a security has been in the past. Many people use a combination of historical volatility, upcoming known events, and general market activity to triangulate a reasonable implied volatility estimate. . Higher expected volatility leads to higher option premiums and vice versa.

- Time to Expiration – The greater the time to expiration, the higher the theoretical price of an option (wider range of outcomes over longer timeframes), all else equal.

- Option Strike Price – The price at which the security can be purchased (call option) or sold (put option) by the option holder prior to or at the maturity date (expiration date)2We are assuming a US readership. “American” options can always have their right exercised while “European” options can only be exercised at maturity..

- The current Risk-Free Interest Rate3Dividends are incorporated into this rate – risk-free interest + dividend yield creates an effective forward rate for an underlying security. A hard to borrow security would result in a higher borrowing cost, which would affect the forward rate. This cost is also incorporated into the “rate” component of the formula. – Theoretical rate of return that an investor would expect on an investment with zero risk. The proxy for this rate is the yield of a Three-Month U.S. Treasury Bill.

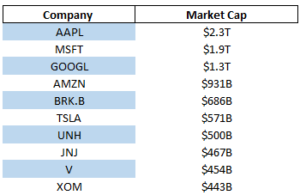

Many option traders are very familiar with 1-4 on this list, but the interest rate component is oftentimes ignored. It’s no secret that rates have risen dramatically over the past two years, especially at the short end of the curve. The graph below depicts the 3-month U.S. Treasury Yield going back to 1990. The rate of ascent from the bottom in rates in early 2022 to present day is the fastest ever, and the current yield of 5.49% is near its highest level over the past 23 years.

All else equal, a higher risk-free interest rate leads to higher call option prices and lower put option prices. Buying options is a way to get leverage and requires less initial investment than owning or shorting shares, though an option buyer must recognize the risk that they may lose all their investment if the underlying security is not above the call strike or below the put strike on the day of maturity. An investor can purchase call options instead of shares to express a bullish view and then use the difference in capital required to invest elsewhere. With interest rates much higher now than they were in early 2022, the opportunity cost of buying shares has increased. Money that would be tied up owning stock can now be invested “risk free” at more than a 5% return. We see the opposite of this phenomenon with put options – traders can buy put options to express a bearish view instead of shorting shares, but shorting stock becomes more profitable as interest rates increase. When you short a stock, the broker will pay interest on the cash that the short sale generated. Since the potential interest earnings are now much higher than before, put options become less valuable.

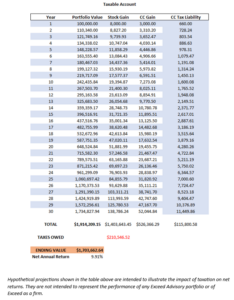

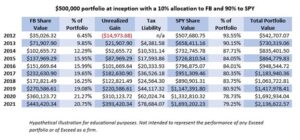

Let’s look at a hypothetical situation involving stock XYZ. We’ll assume that (1) the stock is $100 per share, (2) the strike price of both the call and put option are 100(at the money), (3) the options expire in 90 days, (4) the company doesn’t pay dividends, and (5) the volatility of XYZ shares is 20%. The risk-free rate in January 2022 was around 0.053%, so we’ll use that as a baseline. Given those inputs, the theoretical call price is 3.97 and the put is 3.95.

![]()

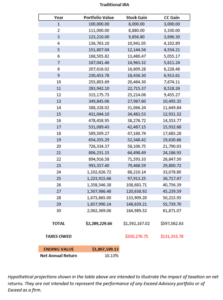

Now let’s assume that nothing has changed except it’s now 10/31/23 and the risk-free rate is 5.49%. Using those inputs, the theoretical call price becomes 4.65 and the put is 3.41 – a 17% increase in the call option price and nearly a 14% decline in the value of the same put option!

![]()

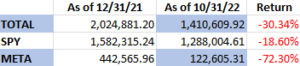

Let’s take this a step further and look at out-of-the-money options, which are more rate sensitive than at-the-money options. Using the same assumptions as before and looking at 10% and 20% out-of-the-money options instead of at-the-money options, the changes in the option prices were staggering. The theoretical price of the 10% out-of-the money call rose by 27% and the 20% out-of-the money call rose by 39% merely from the difference in the risk-free rate between January 2022 and now. Additionally, the price of 10% out-of-the-money put option declined by 23%, and the 20% out-of-the-money put saw a theoretical drop of 34% by adjusting only one variable. All else equal, the farther out of the money an option is, the more its value is affected by changes in interest rates.

Investors can capitalize on these recent market trends and use them to their advantage. It may not make as much sense now as it did in January 2022 to buy a call option (for multiple reasons), but you can flip that dynamic and use the elevated premiums to write covered calls and generate additional income on your stock holdings. With lower relative put premiums now than in 2022, hedging stock positions via buying puts or collars may be more logical now than before.

Options trading is nuanced and complex, with the opportunities that exist largely a product of the market environment. The dramatic spike in interest rates over the past couple years has changed the landscape and creates the potential for higher income generation and lower hedging costs now than before. Contact us for a consultation as to how you can use these developments to your benefit.

IMPORTANT DISCLOSURE: The information in this blog is intended to be educational and does not constitute investment advice. Exceed Advisory offers investment advice only after entering into an advisory agreement and only after obtaining detailed information about the client’s individual needs and objectives. No strategy can prevent all losses or guarantee positive returns. Options trading involves risk and does not guarantee any specific return or provide a guarantee against loss. Clients must be approved for options trading at the custodian holding their assets, and not all retirement accounts are permitted to trade options. Transaction costs and advisory fees apply to all solutions implemented through Exceed and will reduce returns.