Nervous About Your NVDA Gains? A Solution to Both Protect and Participate with No Cash Outlay

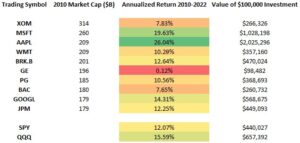

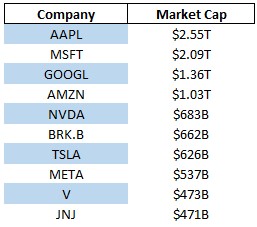

NVDA has been one of the biggest beneficiaries of the recent AI craze, as the company has added 90% to its market capitalization year-to-date and a staggering 251% year-over-year. It’s now the third-largest company in the world with a market cap of about $2.4T, trailing only AAPL ($2.6T) and MSFT ($3.2T). If you or a client have been fortunate enough to ride this rally, you’re likely very pleased by the recent performance but also potentially have excess exposure to shares of this single, volatile company. As we’ve discussed in previous blogs, companies with the highest market capitalization have historically underperformed broad-market indices over longer timeframes. 1https://exceedinvestments.com/where-are-those-top-10-companies-now-nineties-focus/ 2https://exceedinvestments.com/where-are-those-top-10-companies-now-millennium-focus/ 3https://exceedinvestments.com/where-are-those-top-10-companies-now-2010-focus/ This isn’t to say that NVDA is going to underperform the broad market going forward, but history has shown that the upside outliers are scarce.

As a shareholder of a now-concentrated NVDA position, an investor faces the tradeoff of holding a portfolio with elevated embedded volatility that is exposed to greater downside risk versus selling a portion of their NVDA holding to diversify into a balanced market portfolio. However, rebalancing out of a highly-appreciated stock will likely come at the cost of a big tax bill. Thankfully, there is a solution using options that allows investors to hedge downside risk while also participating in significant potential share appreciation, and greatly reducing volatility while deferring and seeking to minimize capital gains taxes.

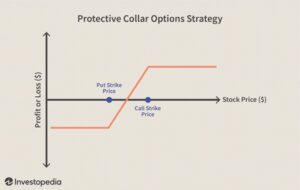

A collar is an option overlay strategy that involves selling an upside call against an existing stock position and using the proceeds from that sale to purchase protective puts that limit downside to a predefined level. A “zero-cost collar” is one of the more popular option strategies and involves matching the premium collected from the sale of the call to the cost of purchasing puts, thus requiring no or very little cash outlay, inclusive of the cost of executing the trade. There is an implicit cost of potential foregone upside in the event the stock rallies above the sold call option strike, but collars can even be structured as a net credit to the investor if so desired, resulting in a cash inflow.

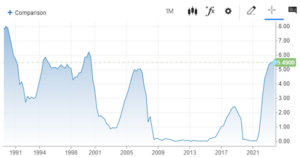

Option prices are dynamic and are partially driven by demand for bullish exposure (calls) versus bearish exposure (puts). When stocks rally sharply, calls are generally more “expensive” relative to puts because of excess investor demand to buy those calls and place bullish bets on continued appreciation. Contrarily when stocks sell off sharply, investor sentiment can shift dramatically and drive excess demand for put options. This is known as skew and is a common metric followed closely by option traders. The recent sharp rally in NVDA has driven call prices significantly higher than puts, creating the potential to use a collar overlay on an NVDA stock position very efficiently. At this point in time, you can sell very “expensive” calls and buy relatively “cheap” put options, maximizing the tradeoff between potential upside appreciation and downside protection via option collars. The chart below depicts the difference in implied volatility of calls versus puts, with the difference in implied volatility of 25-delta (out of the money) options plotted on the Y-axis. When the reading is positive, puts are relatively more expensive than calls, and when the reading is negative calls are more expensive than puts. The put-call skew reading hit an extreme low a couple weeks back, indicating that calls were at their most expensive level relative to puts at any point over the past three years. While this extremely low reading has reverted somewhat higher since then, the current level remains well below long-term averages.

NVDA closed at 925.61 on 3/26, and the options market has a volatility expectation of +/- 43.4% for NVDA shares between now and June 20, 2025, 450 days from today.4Using the midpoint of 6/20/25 option prices as of the market close on 3/26/24 for an at-the-money straddle This means that the options market is currently pricing NVDA to close within a range either 43.4% higher or lower from here, or between about 524 and 1327 by 6/20/25. Options can often be wrong about the realized volatility over a period, but we like to use this as a baseline expectation of outcomes over a certain timeframe to give a general idea how to best structure these trades.

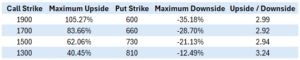

Assuming the options market is correct about its volatility expectation, you can currently sell the 6/20/25 1340-strike call on NVDA for about $110 per contract and buy the 790-strike put for about the same price. What this means is that a holder of an NVDA stock position with this collar overlay can fully participate in 44.8% share upside between now and 6/20/25, while limiting downside risk to a maximum of 14.7%. Perhaps the investor would like a little more upside potential and less downside protection or vice versa – below is a list of currently available collars that can be implemented at close to zero cash outlay. These strategies are fully customizable, so the NVDA holder can choose exactly how much potential upside or downside protection they desire and structure the trade accordingly. As you can see, the potential upside is generally a multiple of maximum downside by about a factor of 3 – this is a result of the excessive skew in NVDA call options that currently exists.

Options trading is nuanced and complex, with the opportunities that exist largely a product of the market environment. Recent trends in NVDA options have created what we view as a compelling opportunity for an investor currently sitting on a concentrated NVDA position. This collar overlay will significantly reduce volatility, allow the holder to still participate in some level of potential appreciation, and defer having to rebalance the portfolio and pay capital gains taxes. Contact us for a consultation as to how you can use the recent developments in the NVDA options market to your advantage.

IMPORTANT DISCLOSURE: The information in this blog is intended to be educational and does not constitute investment advice. Exceed Advisory offers investment advice only after entering into an advisory agreement and only after obtaining detailed information about the client’s individual needs and objectives. No strategy can prevent all losses or guarantee positive returns. Options trading involves risk and does not guarantee any specific return or provide a guarantee against loss. Clients must be approved for options trading at the custodian holding their assets, and not all retirement accounts are permitted to trade options. Transaction costs and advisory fees apply to all solutions implemented through Exceed and will reduce returns.