The Power of Using Options in Retirement Accounts

At first glance, you might be thinking I’m insane to even be mentioning options and retirement accounts in the same breath. After all, options are meant for rampant speculation and are super risky, right? While they can be used for “gambling” purposes if so desired, options are flexible instruments that have a wide variety of uses and benefits, even in qualified retirement accounts such as an IRA.

The main benefit of investing in an IRA is that taxes are either deferred until the money is withdrawn (traditional IRA), or the account can be funded with after-tax dollars and grow over time without accruing any tax liability (Roth IRA). I won’t get into the details too much here, but Roth IRAs generally aren’t available to high-income households, though there are some workarounds. What’s important to note is the potential power of tax deferral and the effect that it can have on a retirement portfolio. This benefit is amplified when using an income-generating strategy such as writing covered calls against existing stock holdings.

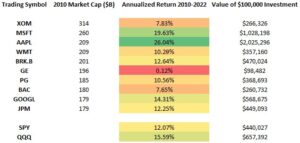

Consider a hypothetical portfolio of $100,000 that’s fully invested in equities. Let’s assume, to illustrate the math, that this portfolio returns 8% every year for 30 years, there are no annual contributions, and the investor implements a covered-call overlay strategy that generates an additional 3% annually in yield. The yield-generating potential of each portfolio depends on the volatility of its holdings, but we think 3% annual yield via covered calls is a conservative assumption. We’ll also assume that this investor is married and sits in the 22% tax bracket, which indicates a total household income range of $89,450 to $190,750 for 2023. For simplicity’s sake, we’ll also assume that no stock holdings are sold at any point until the end of this 30-year period. Lots of unrealistic assumptions here-especially the lack of volatility, which is obviously significant in the real world-but the simplicity helps make the point about the effect of taxes, since that’s the only factor that differs in the three scenarios shown. Here’s what the growth of this hypothetical portfolio would look like over time. The “Portfolio value” column is a beginning of year number.

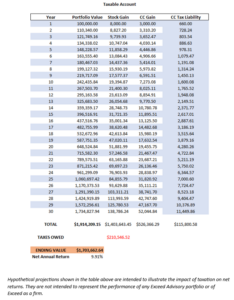

Profits from covered calls are taxed as capital gains, and in this example the tax rate is 22%. This tax liability is subtracted from the portfolio value every year and is a drag on the effects of compounding. The stock gain at the end of this 30-year period is taxed at 15%, the long-term capital gains rate for married couples earning $89,251-$553,850 annually. While this hypothetical investor accumulated significant wealth over this period, the taxes due each year from the covered-call returns were a drag on total returns.

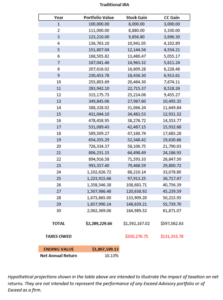

Now let’s look at the numbers had this $100,000 originally been held in a traditional IRA. The assumptions remain the same as the example above in the taxable account, but the tax treatment is different. In a traditional IRA, all taxes owed are deferred until retirement, which we’re assuming is in 30 years. The tax rate on all gains in a traditional IRA is the income tax bracket that the investor resides in, which in this case is 22%. Both the stock and dividend profits will be taxed at 22%, but not until the end of this thirty-year period.

The deferred tax treatment in this case led to an additional net return of 0.22% annually. While this doesn’t seem like much on the surface, this can be significant over 30 years. In this example, that equated to an additional $103,936 in portfolio value! This amount would be even greater over a longer time horizon, or if the assumed returns were higher.

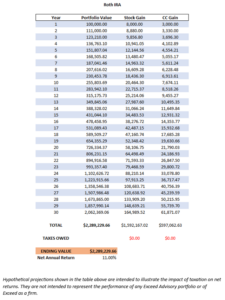

Lastly, let’s look at the numbers if this hypothetical portfolio was in a Roth IRA. Roth IRAs allow for all gains to grow tax free. The drawback to Roths is that there are annual contribution limits, income requirements, and if you roll an existing retirement account into a Roth IRA, you’ll likely owe income taxes on that money at inception. Most retirement accounts are funded with pretax dollars whereas a Roth IRA is funded with post-tax dollars. However, once this one-time tax is paid, you’ll never have to pay another penny in taxes on that account, assuming the appropriate rules are followed.

As you can see, the effect of not having to pay annual or terminal taxes on this account is substantial. An additional 0.87% net return annually (via tax savings) from a Roth IRA versus a traditional IRA equated to $481,631 more in portfolio value at the end of this period. This is a great example of how being tax savvy at the margin can have a dramatic effect on wealth as time goes on.

Retirement accounts aren’t generally where you see option activity, but small return enhancements over time can really add up. Using a covered-call overlay strategy inside of a tax-advantaged account can reduce volatility, potentially increase returns on both an absolute and risk-adjusted basis, and have a significant effect on retirement wealth.

IMPORTANT DISCLOSURE: The information in this blog is intended to be educational and does not constitute investment advice. Exceed Advisory offers investment advice only after entering into an advisory agreement and only after obtaining detailed information about the client’s individual needs and objectives. No strategy can prevent all losses or guarantee positive returns. Options trading involves risk and does not guarantee any specific return or provide a guarantee against loss. Clients must be approved for options trading at the custodian holding their assets, and not all retirement accounts are permitted to trade options. Transaction costs and advisory fees apply to all solutions implemented through Exceed and will reduce returns.