Tax Avoidance Gone Wrong – The Rise and Fall of Facebook

Facebook’s IPO was one of the hottest ever. The company was growing at an astounding rate as social media went fully mainstream, and everyone wanted in on the action. Facebook went public on May 12, 2012 at $38 per share, and after some initial weakness the stock price experienced a meteoric rise over the next nine years. Despite FB declining more than 50% in the months immediately following its initial offering, a buy-and-hold investor who purchased shares on the day of its IPO saw a return of 10 times their initial investment between 2012 and 2021.

Fast forward to present day and the situation looks much different for holders of Facebook (now Meta) shares. Increasing competition from TikTok, government regulation, market saturation, and a deteriorating macroeconomic environment have led to a 75% peak-to-trough decline over the past thirteen months. The paper gain that existed for these IPO investors wilted from 900% to less than 150% in the span of a little over a year. Life comes at you fast.

It’s easy to look back and wonder why someone holding a concentrated position in Facebook shares didn’t sell or at least reduce their position after such a big rally, but there are monetary and psychological reasons why investors struggle to dispose of appreciated assets. Human emotions and greed aside, the primary reason investors hesitate to sell stock after a big gain is capital gains tax. Let’s take a look at the math by illustrating a hypothetical investment in FB shares on its initial public offering…

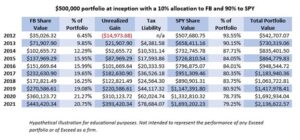

Assume an investor allocated 10% of their $500,000 portfolio to FB shares at the IPO price of $38, and the remaining 90% of their capital was invested in a diversified market fund. For simplicity’s sake, in this example we’ll use the SPDR S&P 500 ETF trust (symbol SPY), an exchange traded fund (ETF) that aims to track performance of the S&P 500 index. So, on 5/18/12 this hypothetical e-portfolio consisted of $50,000 in FB shares and $450,000 in SPY shares. The table below shows the performance of the Facebook and SPY positions, using end-of-year values. This illustration also assumes a 20% capital gains tax rate.

As you can see the Facebook position quickly grew into a substantial percentage of the total portfolio holdings. While this is obviously a good thing, it creates a myriad of other problems that can arise in buy-and-hold investing. Portfolios with concentrated positions are a recipe for underperformance. Studies have shown that not only do concentrated positions raise the overall risk and volatility profile of a portfolio, but historically those portfolios have also exhibited suboptimal returns.¹ Heavy concentration in a single-stock position creates the potential for catastrophic losses, which can take many years to recoup. Lastly, managing a concentrated portfolio is more difficult than simply rebalancing a “standard” diversified portfolio of stocks and bonds.

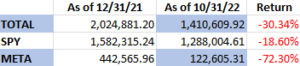

Below are the 2022 returns and position values for the hypothetical portfolio described above. You’ll notice that the portfolio is underperforming the S&P 500 by over 11% this year, and this can be attributed solely to the concentrated position in META shares. Adding insult to injury, the equity underperformed the broad market over virtually every timeframe this year, and at an elevated level of volatility. META has a five-year monthly beta of 1.32, compared to a market beta of one. Not only did shares of META underperform the market on a gross basis, but even more so on a risk-adjusted basis. Poor returns by assets with higher risk profiles can be detrimental to risk-adjusted performance metrics like Sharpe and Sortino Ratios.

So why didn’t our theoretical investor simply sell some shares to reduce risk? Most likely, they wanted to avoid paying a 20% capital gains tax. Based on a 20% capital gains rate, the theoretical taxes owed if the investor had liquidated the position at the end of 2021 were more than 150% of the initial investment and nearly 4% of the total portfolio value! On the face of it, deferring this sale seems logical, as that tax can be seen as an immediate loss. However, calculations suggest that investors who choose to liquidate their concentrated positions and pay capital gains tax are making the optimal decision. Reducing volatility has a first-order effect on the long-run growth and preservation of wealth.¹

The good news is that there are solutions to these common problems. Options are often (and rightly) viewed in a negative light among retail investors, as they can be very risky and lead to substantial losses. Options are complex and can be intimidating to even the most seasoned investor. What many people don’t realize, though, is that options can also be powerful tools for tax optimization and hedging within a portfolio. When correctly implemented, an option overlay strategy may completely eliminate tax liability on certain concentrated positions, while simultaneously hedging downside risk. There are of course transaction costs involved, as well as advisory fees in the case of an overlay strategy, but the ability to exit these positions tax neutrally while also reducing portfolio volatility can have a substantial effect on long-term capital appreciation.

If you or a client are dealing with how best to address the tax liability and downside risk concerns that often accompany concentrated positions, feel free to reach out to the team at Exceed Investments. Members of Exceed’s Portfolio Management Team have over 38 years of professional options experience and are well-versed in the tax code. These strategies can be tailored to fit specific investment goals and satisfy immediate needs. When executed properly, these option overlay strategies can reduce or eliminate tax liability, lower risk, and help you and your clients achieve their financial goals in an efficient manner.

¹ Nathan Sosner, “When Fortune Doesn’t Favor the Bold. Perils of Volatility for Wealth Growth and Preservation. ”The Journal of Wealth Management Winter 2022, jwm.2022.1.189; DOI: https://doi.org/10.3905/jwm.2022.1.189

This blog post is for informational or educational purposes only and is not intended as investment advice. Any discussion of investment strategy or approach is intended only to illustrate investment concepts and in no case does the discussion represent Exceed Advisory’s investment performance or the results of any Exceed Advisory portfolio. We provide investment advice only to clients and only after entering into an advisory agreement and obtaining information concerning individual needs and objectives. We think the information provided is accurate but accuracy is not guaranteed. All investing in securities involves risks, including the risk of loss.