Option Based Portfolio Management

Exceed Investments

Let Us Be Your Options Expert

Why Options?

Options can provide advantages in all market environments:

In flat markets, they can provide higher yield.

Covered Calls

- Monthly Yield

- Additional participation and protection

- Low market correlation

In down markets, they can partially or fully offset loss.

Collars

- Tail-risk protection

- Participate on upside

- Consistent, low volatility performance

In up markets, they participate in a predetermined percentage of the uptick – including leveraged opportunities.

Leveraged spreads

- Leveraged Upside

- Potentially add buffered protection

- Take advantage of bull market environments

Across complete market cycles, they may reduce risk and improve absolute returns.

Tactical Approach

- Protection + Participation

- Take advantage of option characteristics

- Take advantage of market environments

Option trading can be complicated and risky, and some strategies may cause you to lose your entire investment. See Disclosures

Why Exceed

Performance

A history of strong risk-adjusted performance across our portfolio of strategies – Contact us for the most recent fact sheet and performance metrics

Experience

Principals’ past experience includes: Exchange specialists and market makers, Global bank trading, Risk Management, Proprietary, and Institutional Level Portfolio Management: Institutional level $1B+ portfolios on behalf of ING and Lehman.

Innovation

Pioneer / early implementer of defined outcome / structured note strategies with ‘40 act product and indexes.

Partnership

A history of strong partnerships including current alliances with Schwab, Fidelity, Catalyst Funds, and Tactical Fund Advisors

Let Us Be Your Options Expert

Options Have Many Benefits, But are Complex

Strategy Spotlight

Option strategies provide a number of unique benefits that may add further diversification, a better fit for an investment goal, and potential for alpha. If seeking a market hedge, generating yield, or a combination of both, option strategies may be for you. Following are a couple of examples that illustrate the power of option solutions.

Legend

- Buffered Shield Strategy

- S&P 500

- Stepped Up Floor

1. Protect

2. Participate

3. Step Up Protection

For illustrative purposes only. Not intended to represent the actual performance of any strategy or of Exceed’s investment results.

Option trading can be complicated and risky, and some strategies may cause you to lose your entire investment. See Disclosures

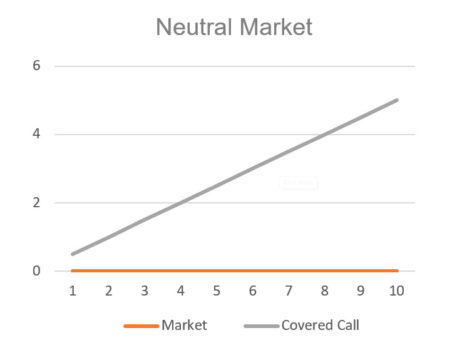

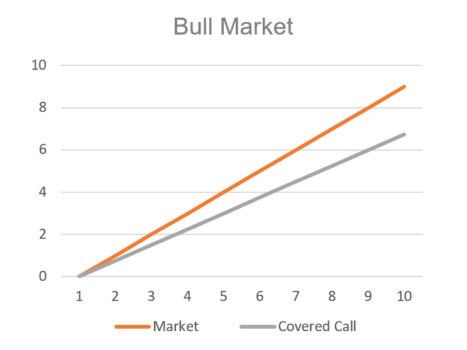

Strategy Spotlight: Covered Call

- Provide additional yield in “flat” markets

- Low correlation to markets

- Reduce cost basis

- Maintain investment horizon

- Opportunistic in volatile markets

- Participation on upside movement

- Capture excess premium

- Possible double benefit

For illustrative purposes only. Not intended to represent actual performance of any strategy or of Exceed’s investment results.

Option trading can be complicated and risky, and some strategies may cause you to lose your entire investment. See Disclosures

Who We Are

Over 40 years of options-focused experience including both listed and over the counter trading, engineering option based strategies in multiple instruments (including structured notes, indexes, mutual funds, and institutional level portfolios), advising, managing and educating, the Exceed team can assist in your needs.

Joe Halpern

Joe Halpern

Over a 25 year financial career, Mr. Halpern has structured, priced, and traded billions of dollars in structured products, exotic derivatives, and listed vanilla options in addition to managing trading groups, supervising risk management and participating in executive level, firm-wide strategic initiatives.

Mr. Halpern founded Exceed Investments in order to take advantage of the unique characteristics that options present in defining, hedging, and/or optimizing a market exposure. Exceed’s first initiative was to combine the beneficial elements of structured notes with that of mutual funds. Exceed currently sub-advises on four mutual funds that use elements of structured notes in providing a defined level of downside protection. Consistently a thought leader in the space, under the direction of Mr. Halpern Exceed continues to innovate, resulting in a number of 1sts in the industry inclusive of the first mutual fund using a structured notes approach, optimization features allowing for evergreen characteristics, and with more to come.

Prior to founding Exceed Investments, Mr. Halpern was a Director at Lamco, the asset management division of Lehman Brothers Holdings Inc. He managed the exotic derivatives commodities book, a multi-billion complex OTC derivative portfolio, was the chief negotiator on a number of global bank settlements and was a lead member of a task force on structured products.

Prior to joining Lamco, Mr. Halpern was Director on the Equity Derivatives Trading desk of ING Financial Markets, a global financial institution. As a Director, Mr. Halpern was responsible for structuring, pricing, and trading an array of exotic derivatives for the global sales force. Prior to joining ING, Mr. Halpern was SVP of Strategy and Risk for Kellogg Capital Group’s derivatives division.

From 1996 to 2002, Mr. Halpern was at Letco Specialists, since acquired by TD Securities, where he began his career as a derivatives trader. Mr. Halpern became the youngest partner at Letco Specialists. He was responsible for the IT build-out for the company’s east coast operations while managing a trading division and a proprietary portfolio. He was also the primary market maker on the American Stock Exchange in a number of highly volatile, active derivative listings.

Mr. Halpern lives in New York City with his wife and three children.

Bryan Sapp

Bryan Sapp

Mr. Sapp has spent the last 14 years of his career analyzing and trading financial markets. Prior to joining Exceed, Bryan was a Senior Market Strategist at Schaeffer’s Investment Research, where he designed, managed, and evaluated various equity option strategies. In addition to his trading responsibilities, Mr. Sapp provided unique options education for hundreds of thousands of investors at both the institutional and retail level.

Bryan joined Exceed in 2022 to lead the initiative of tax optimization for concentrated positions and other hedging and yield-generating strategies.

Mr. Sapp is a CFA Charterholder and lives in Rockford, IL with his wife and two sons, George and Theo.

Opportunities To Partner

Product Expertise

- Separately Managed Accounts

- Portfolio Management

- Option Strategies

- Trading

- ETFs

- Indexes

- Mutual Funds

- Insurance structures (Annuities, VIT)

- Structured Notes

Business Expertise

- Strategy Development

- Strategy & Structure Alignment

- Product Positioning

- Product Launch

Blog

October 29, 2025

At Exceed, we’re always looking for ways to help advisors give their clients more control, flexibility, and tax efficiency. Our newest offering — Box Spread Lending — does exactly that. This strategy enables investors...Read More

October 8, 2025

The Psychology of Waiting – Why Investors Delay Hedging Until It’s Too Late

When markets are calm and portfolios are climbing, it’s easy to feel like risk management can wait. After all, why hedge when everything looks fine? But that’s exactly when investors are most vulnerable —...Read More

August 19, 2025

Why Options Strategies Belong in Portfolios with Concentrated Positions

In today’s unpredictable market environment, traditional portfolio strategies are being put to the test. With persistent volatility, inflation pressures, and questions about the future of interest rates, many advisors are searching for tools that provide...Read More

May 20, 2025

Overlay Economics: Evaluating the True Cost (and Value) of Options Strategies – Featuring NVDA

When financial advisors evaluate an investment or strategy, one of the first questions is: What does it cost? But with options-based overlay strategies—especially for managing concentrated stock positions—the answer isn’t always straightforward. Overlay strategies aren’t...Read More

May 7, 2025

The Psychology of Concentrated Positions: Helping Clients Take Action Through Structure

Every advisor has a client with a concentrated stock position they won’t sell. It might be a tech founder sitting on millions in their company’s shares, an executive with decades of accumulated stock options, or...Read More

April 3, 2025

Common Misconceptions About Option Strategies: What Advisors Need to Know

Options can be a powerful tool for financial advisors looking to enhance client returns, manage risk, and potentially exit a concentrated position in a tax-efficient manner. However, many advisors hesitate to incorporate options due to...Read More

View Our Most Recent Blog Posts

"*" indicates required fields