How Risky is Box Spread Lending? Understanding Drawdowns, Margin, and Capital Preservation

When advisors first encounter box spread synthetic lending1Box spreads offer a form of synthetic loan that locks in an effective “borrowing” rate based on the trade structure described in the article. For simplicity we’ll use the terms “loan,” “lending,” and “borrowing,” while also adding clarification where needed., the focus is usually on two things: the attractive effective borrowing rate and the tax-efficient treatment of the cost. Both are important, but the more fundamental question for any fiduciary is simpler:

What External Risks Affect a Client Using Box Spread Lending?

Understanding the risk profile of box spread lending requires looking beyond the attractive cost of the loan and into how these positions interact with portfolio exposure, margin requirements, and drawdowns.

A Box Spread is a Fixed Liability, Not a Market Bet

A properly constructed box spread creates a fixed obligation at expiration. The difference between the two strike prices defines the exact dollar amount that will be owed in the future. That amount does not change with market movements.

From a risk standpoint, that means a box spread behaves much more like a traditional loan than a trading position. There is no delta, no gamma, and no exposure to market direction. The only thing that may change as markets move is the value of the portfolio supporting the position.

That distinction is critical. The risk of box spread lending is not that the trade itself goes wrong — it’s whether the portfolio’s equity remains sufficient to support the fixed obligation.

How Margin Really Works

When a client uses box spreads to access liquidity, the resulting position creates a margin debit inside the brokerage account. The broker then applies two requirements:

- Initial margin, which governs how large the box can be at inception

- Maintenance margin, which governs how much equity must be maintained over time

A typical portfolio holding all ETFs has an initial margin requirement of 60%, meaning the investor can borrow up to 60% of the account value. With an all-equity portfolio, the typical initial margin requirement is 50%. At most custodians, the typical maintenance margin requirement is 30% for ETFs and 35% for equities. These numbers are crucial in determining the amount that can be borrowed against the portfolio and the resulting margin of safety before there’s risk of a margin call.

In practice, this creates far more room for market fluctuations than most advisors realize. For this example, we’re using a 50% initial margin and 35% maintenance margin requirement (typical for all-equity portfolios).

What a Conservative Structure Looks Like

Consider a client with a $10 million portfolio who uses a box spread to borrow 20% of that value — or $2 million — for liquidity purposes (for example, to buy a vacation home).

If the client withdraws or deploys that cash elsewhere, the remaining invested portfolio is $8 million, with a $2 million fixed obligation outstanding.

Using a 35% maintenance requirement, the portfolio value would need to decline to approximately $3.1 million before a margin call is triggered. That implies a drawdown of roughly $4.9 million from the original $8 million starting point.

The risk of receiving a margin call when using box spread lending versus a traditional margin loan is identical. It’s all dictated by math, and the margin and equity requirements are the same.

Why Box Spreads Are More Stable in Stress

- The rate is locked.

Unlike margin loans or SBLOCs, which float with short-term interest rates and can be repriced at any time, box spreads lock in a fixed repayment from day one. There are no surprise rate hikes or credit committee decisions. - The liability is transparent.

The future amount owed is known in advance and does not change with market volatility. This makes cash-flow and risk management far more straightforward. - The margin rules are mechanical.

The clearinghouse and broker apply formulaic margin requirements rather than discretionary credit judgments. While there’s always a risk that the clearing firm could unilaterally raise maintenance margin rates, especially during times of significant market declines, that’s rare and is mitigated by ensuring the account has significant excess equity to begin with.

Sizing is What Can Make It Safe

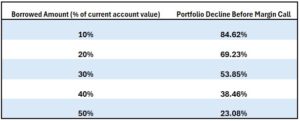

The key to using box spread lending responsibly is sizing. When clients borrow modestly — for example, 10% to 30% of portfolio value — the amount of equity cushion above the margin threshold is substantial.

This is fundamentally different from using leverage to increase market exposure. In a box spread, the borrowed funds are typically used for external liquidity needs: tax payments, real estate purchases, business investments, or private equity capital calls. The portfolio itself remains invested.

That distinction allows advisors to frame box spreads not as a speculative tool, but as a disciplined way to unlock capital without disrupting long-term strategy.

Putting Risk in Perspective

No financing structure is risk-free. If a portfolio were to experience an extreme drawdown, any form of borrowing could come under pressure. The advantage of box spreads is that the threshold for that pressure is usually much lower than most people assume — and much higher than many alternatives allow.

By anchoring borrowing to transparent, exchange-based pricing and conservative margin mechanics, box spread lending offers a rare combination: low fixed cost, predictability, and meaningful resilience to market volatility.

For advisors, that makes it not just an efficient source of liquidity — but a defensible one.

Final Thought

The real question isn’t whether box spread lending has risk. It’s whether it has less risk than the alternatives when structured thoughtfully.

When used within a prudent sizing framework, box spreads can give clients access to capital without sacrificing control over their portfolios — and without exposing them to the fragility that often accompanies traditional forms of borrowing.

That’s what makes them such a powerful tool in the modern advisor’s toolkit.

IMPORTANT DISCLOSURE: The information in this blog is intended to be educational and does not constitute investment advice. Exceed Advisory offers investment advice only after entering into an advisory agreement and only after obtaining detailed information about the client’s individual needs and objectives. No strategy can prevent all losses or guarantee positive returns. Options trading involves risk and does not guarantee any specific return or provide a guarantee against all loss. Clients must be approved for options trading at the custodian holding their assets, and not all retirement accounts are permitted to trade options. Transaction costs and advisory fees apply to all solutions implemented through Exceed and will reduce returns. Specific securities discussed are intended to illustrate the concepts covered and do not constitute a recommendation of any security and do not purport to represent the performance or holdings of any Exceed portfolio.